React developers spend an average of 30-40% of their time on repetitive tasks and time-consuming updates that follow the same pattern. At Absolute App Labs, we found ourselves trapped in this cycle. We needed to find a way to keep the velocity of the project high without letting the quality slip. We tried experimenting by implementing cursor AI into our workflow. Check out how we implemented cursor AI into our workflow. The AI in our React development workflow helps us handle repetitive code, spot potential errors before they escalate, and keep components consistent. The result of this integration was a faster iteration process that helped developers focus on logic. We’ll share how we use Cursor AI in our projects to tackle these struggles and build products faster. A strong AI workflow for building React apps focuses on speed, consistency, and long-term maintenance. It starts with a structured React setup using TypeScript, clear component boundaries, and shared coding patterns. Scalability improves when the workflow reduces manual effort during development. Teams that integrate AI-assisted tools like Cursor AI into their React workflow spend less time writing routine code and tracing bugs across files.

Building React apps involves complex applications with numerous interconnected components; keeping these codes consistent is a common pain point that makes development difficult. A lot of React development is repetitive. Every new feature starts with the same setup: creating components, wiring props, managing state, and adding routine code. Writing these is a tedious process that takes away time that is required to solve product problems. Debugging in large React apps requires jumping between files to understand how data flows, and one small change can affect multiple components. Debugging then becomes a time-consuming process, hopping between files, and figuring out why the code broke. Refactoring is not any easier; teams have to balance improving code without introducing new bugs. Without proper support, developers spend more time fixing issues than building new functional features. Hiring more developers might not always make the process easier, because there are differences in how each developer structures components or has different patterns in writing. This could make the codebase harder to understand and build.

Integrating Cursor AI became a part of our React workflow to help the team work faster without sacrificing quality. It handles repetitive coding tasks and supports debugging, so developers can spend more time building features and improving the user experience. This is how we apply AI-assisted React development to make our process more consistent. Creating new components used to take a lot of repetitive work. With Cursor AI in our React workflow, we can generate components that follow our existing patterns automatically. This saves setup time and keeps code consistent. Refactoring can be difficult if you’re not aware of where components are used. Cursor AI reads the surrounding code and suggests safe changes. This workflow for developers reduces the risk of breaking things and speeds cleanup, making the codebase easier to maintain as the app is developed. Debugging large React apps is usually slow because the data flows through multiple components, and a small change in one file can create unexpected bugs elsewhere. Cursor AI, our AI-powered code editor, analyzes the surrounding code and identifies potential problems as you type. It can suggest fixes, highlight conflicts, and even point out where state or props might break a feature.

A legal services firm approached Absolute App Labs, in need of a React-based application that could simplify how users interact with legal information and workflows. The app required dynamic forms, reusable UI components, and the ability to handle frequent feature updates as legal processes evolved. The project faced challenges common to complex React apps:

We integrated Cursor AI into the React development workflow to reduce manual effort while keeping our developers in control. Cursor AI generated new components following existing project patterns automatically, reducing setup time. The AI analyzed surrounding code and suggested safe changes, helping developers refactor without introducing errors. The AI highlighted potential issues as developers typed, reducing time spent tracing bugs across multiple files. The AI ensured that all code followed established conventions, making it easier to maintain as the project grew.

With AI-Assisted React development, your workflow can keep up with your team instead of slowing them down. Cursor AI turns tedious work into something that the team doesn’t have to think about reworking the code. At Absolute App Labs, we’ve seen how building React apps faster is not about the coding speed, but rather about having a smarter workflow. By combining AI-assisted tools with our ReactJS development process, our developers now focus on building better features, improving UX, and scaling projects. The next step is to adopt an AI-automated workflow and gain an advantage of freedom to be innovative in future projects.

Launch Your Product With Smarter React Development Workflow

Absolute App Labs combines AI and smart workflows to help your product go live faster, smoother, and without delays.

Yes, by reducing errors and speeding up iterations, teams can focus on UX improvements, feature innovation, and delivering reliable, scalable apps.

Tasks like creating code components, refactoring existing code, debugging across files, and maintaining code patterns benefit most. Cursor AI helps reduce manual effort and ensures safer, faster development.

Yes, Cursor AI helps small teams prototype faster, maintain quality, and scale their codebase efficiently without adding extra manual work.

Yes. Cursor AI works alongside your current tools and processes, enhancing component creation, debugging, and refactoring without disrupting your existing codebase.

A good React tech stack includes React with TypeScript for type safety, state management tools like Redux or Zustand, component libraries like Material-UI or Tailwind, and testing frameworks such as Jest or React Testing Library. Adding AI-assisted tools like Cursor AI can further simplify your development.

What Is the Best AI Workflow for Building Scalable React Apps?

Why Building React Apps Is Difficult Without the Right Workflow

Repetitive Coding Slows Down Feature Delivery

Debugging and Refactoring Consume Time

Scaling Teams Can Break Code Consistency

How Cursor AI Fits Into Our Development Workflow

AI-Assisted Component Creation

Refactoring React Components

AI-Powered Debugging Support

Case Study: Accelerating Application With AI-Assisted React Development

Challenges Before AI Integration

Our Approach: Introducing Cursor AI

How Cursor AI was applied

Outcome of Using AI-Support

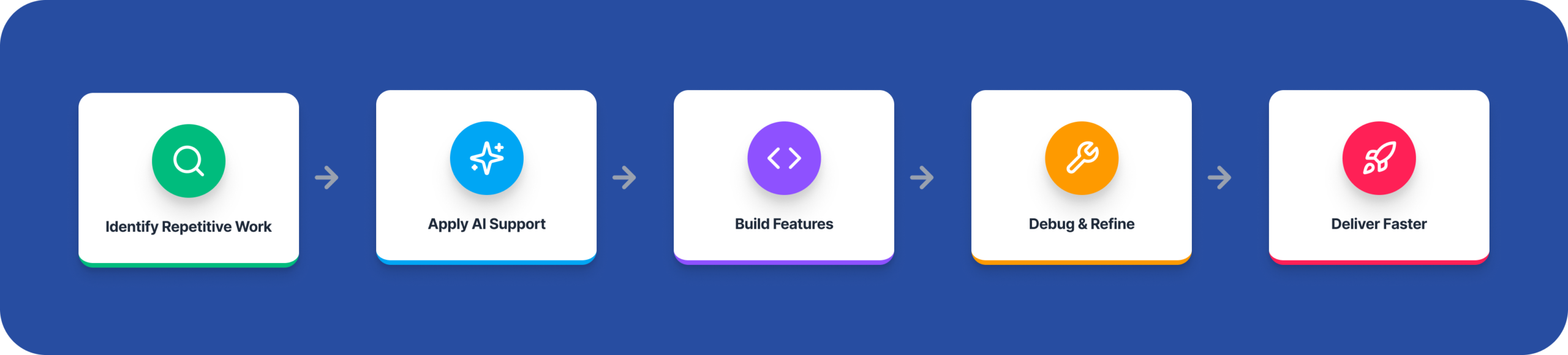

How to Build React Apps Faster With AI: Step-by-Step

Step 1: Identify Repetitive Work

Step 2: Apply AI Support

Step 3: Build Features

Step 4: Debug & Refine

Step 5: Deliver Faster

Conclusion

FAQ

Does using AI-assisted development improve product quality?

What types of tasks in React development benefit most from AI support?

Can AI-assisted React development work for startups with small teams?

Can Cursor AI integrate with my existing React development workflow?

What is the best tech stack to build React Apps?

Google Play’s 16KB page-size requirement is now officially in effect. As of November 1, 2025, all new apps and updates targeting Android 15+ must support 16KB page sizes, or they will crash on upcoming high-end devices.

If your app uses native code, the only way to stay compatible with the current and future smartphones is to:

- Rebuild your binaries with NDK r28+

- Make sure the 16KB ELF segment alignment

- Test your APK in a 16KB Android 15 emulator and verify it with zipalign

This guide walks you through exactly how to check, fix, and validate your app so it continues to run smoothly on next-generation 16KB devices.

What Is the 16KB Page Size Requirement?

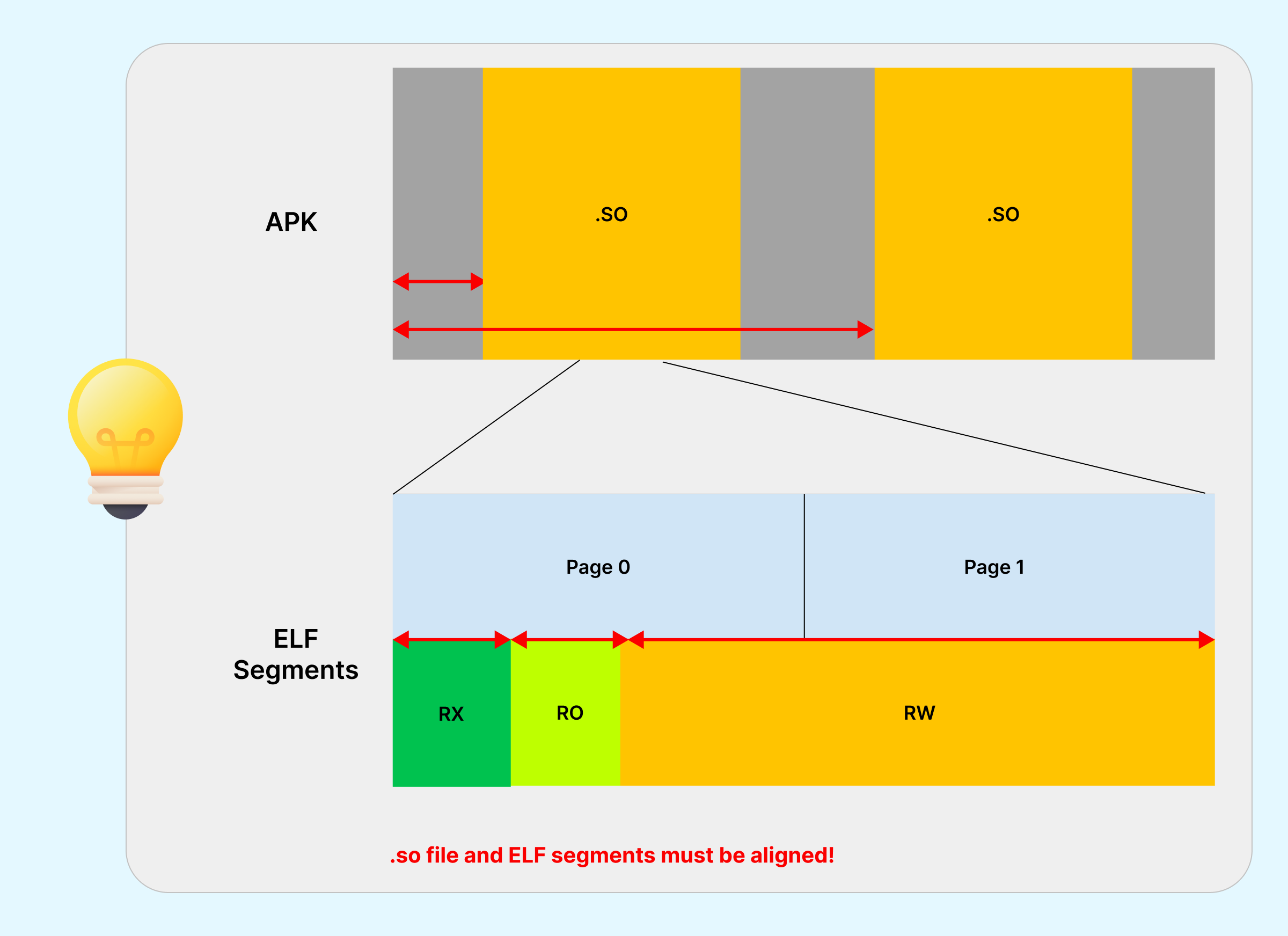

Android 15 introduces support for 16KB memory pages, and Google Play now requires that all native binaries inside your APK/AAB are aligned to a 16KB boundary.

This applies specifically to ELF segments in your .so files.

Who is Impacted?

This requirement primarily affects apps that use native code. If your app relies only on code written in Kotlin or the Java programming language, including all its SDKs and libraries, you are likely already compliant.

You need to take action if your app uses any form of native code, including:

a. C/C++ code built with the Android NDK

b. Third-party SDKs that come out with .so libraries

c. Game engines or custom native libraries

d. Any dependency that bundles native binaries

These native binaries must have their ELF segments (Executable and Linkable Format) already compatible with the 16KB boundary.

Why is Android Moving to 16KB Pages?

1. OEM Hardware Trends

Latest flagship devices with ARMv9 offer multiple page size configurations, and OEMs are increasingly experimenting with and adopting 16KB builds to improve memory efficiency on high RAM devices. Supporting both 4KB and 16KB adds kernel and vendor fragmentation, increases BSP maintenance, and complicates long-term updates. Standardizing on 16KB helps unify the arm64 ecosystem and simplifies future platform work.

2. Better System-Level Performance

16KB produces measurable gains at the system level, especially for large apps and workloads with high memory churn:

- Fewer page faults

- Better TLB reach

- Lower kernel memory overhead

- Faster cold starts under pressure

More than apps, these upgrades are systemic and align Android with modern ARM memory architectures.

3. Preparing for 16KB-Only Configurations

Some upcoming ARMv9 device configurations may be available with 16KB as the only supported page size.

Any native code that assumes 4KB pages, performs manual offset calculations, or ships with unaligned ELF segments risks:

- Native library load failures

- Crashes on startup

- Undefined behavior on 16KB devices

Google’s requirement makes sure that apps built today will continue to run on tomorrow’s hardware.

4. Reducing Play Store Fragmentation

Similar to the 64-bit transition or API level enforcement, Google is tightening compatibility to reduce ecosystem fragmentation. Just to make sure, all new and updated apps targeting Android 15+ must be 16KB-compatible.

With this, what will developers get?

The app doesn’t require a redesign. Once the platform moves to 16KB pages, the benefits are:

- Faster app launches (up to ~30% on affected devices)

- Lower power draw

- Smoother system performance

- Better behavior under memory pressure

Your only responsibility is to ensure all your native code and third-party .so files are built and aligned correctly for 16KB.

What Happens If Your App Is Non-Compliant?

a. App Instability Update Your Build Toolchain Crashes: This step serves as the core Android 16KB page size fix for native code. If your app or its dependencies contain native code not aligned to 16KB, it may fail to work on devices with 16KB pages, causing crashes or runtime errors at launch.

b. Exclusion from Future Devices: Apps that are not 16KB-compliant will not run on devices using 16KB, limiting access to high end devices with 8GM RAM or more.

c. Memory Inefficiency: Apps that partially rely on a 4 KB page size may cause the kernel to allocate a full 16KB page, leading to wasted memory and reduced performance.

Unsure Why Your App Fails to Launch on New Android Phones?

We handle native library fixes, NDK updates, ELF alignment, and 16KB testing to prevent startup crashes.

Guide to 16KB Compliance: How Can Teams Achieve Compliance?

Follow this roadmap to identify, fix, and verify 16KB alignment issues in your app.

1. Check If Your App is Impacted (APK Analyzer)

a. Open Android Studio.

b. Go to Build > Analyze APK and select your app’s APK file.

c. Look for the lib folder. Presence of .so files indicates native code.

d. Android Studio’s APK Analyzer and Lint will flag any 16KB alignment issue in the Alignment column, helping you quickly identify non-compliant binaries.

2. Update Your Build Toolchain

- Update to the latest Android SDK tools and Android NDK (r28 and higher).

- Newer NDK versions include NDK 16KB page size support, and NDK r28+ compiles 16KB-aligned by default, removing the need for manual configuration for first-party native code.

3. Resolve Hardcoded Page Size Assumptions

- Avoid hardcoding 4096 in native code, especially in mmap() calls.

- Use Runtime Functions: Replace hardcoded values with runtime functions that query the device for its actual page size:

- Use getpagesize()

- Use sysconf(_SC_PAGESIZE)

In NDK r27 and higher, PAGE_SIZE is now undefined when 16KB mode is enabled, encouraging this best practice.

4. Manual Alignment and 16KB ELF Segment Alignment (For Older NDK/Build Systems)

If using NDK r27 or lower, manually enable 16KB ELF alignment via linker flags:

| Build System | Configuration |

|---|---|

| CMake | target_link_options(${CMAKE_PROJECT_NAME} PRIVATE "-Wl,-z,max-page-size=16384") |

| ndk-build | LOCAL_LDFLAGS += "-Wl,-z,max-page-size=16384" |

| Gradle (for CMake/ndk-build) | Pass argument: -DANDROID_SUPPORT_FLEXIBLE_PAGE_SIZES=ON |

Note: Pre-built third-party native libraries must also be recompiled using a 16KB-aligned toolchain. Check with SDK providers.

5. Test in a 16KB Environment

a. Set up the Environment: Use the Android Emulator with a 16KB-based Android 15 system image, available via the SDK Manager in Android Studio.

Alternatively, enable the “Boot with 16KB page size” developer option on supported physical devices.

b. Verify Page Size: On your test device, run the following command to confirm the environment is 16KB:

adb shell getconf PAGE_SIZE

# Expected output: 16384

c. Verify APK Alignment: Use the zipalign tool to verify the final APK alignment. This step helps you check alignment using the zipalign -P 16 -v 4 command, ensuring your APK is correctly prepared for 16KB devices.

zipalign -c -P 16 -v 4 APK_NAME.apk

# The command should succeed without errors.

d. Thoroughly Test: Focus on native code-heavy areas (e.g., camera, large data operations, game physics) to catch runtime issues.

Conclusion

Google Play’s 16KB page size requirement represents a significant leap forward in Android performance optimization. More importantly, making sure the compliance for your app will make it run smoothly on the next generation of high-end Android devices.

Need assistance with Android app development and alignment issues? Absolute App Labs provides audits and fixes to keep your app running smoothly.

Technology keeps updating, and don’t let it hold back your app’s potential. Let’s make your Android application ready for the future.